A very high ratio hints. If not then may need to adjust pricing policy to keep up with costs.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

A WCR of 1 indicates the current assets equal current liabilities.

. Asset-based income tax regime has the meaning given by section 830- 105. Log in with Facebook Log in with Google. Some sectors like retail will more likely see a good ratio around 2.

Others particularly that are service-based will have a much lower ratio. Year 2 witnessed a slight decrease of firms current asset turnover ratio from 510 to 503 comparing to year 1. The nature and risk of each revenue source should be analyzed.

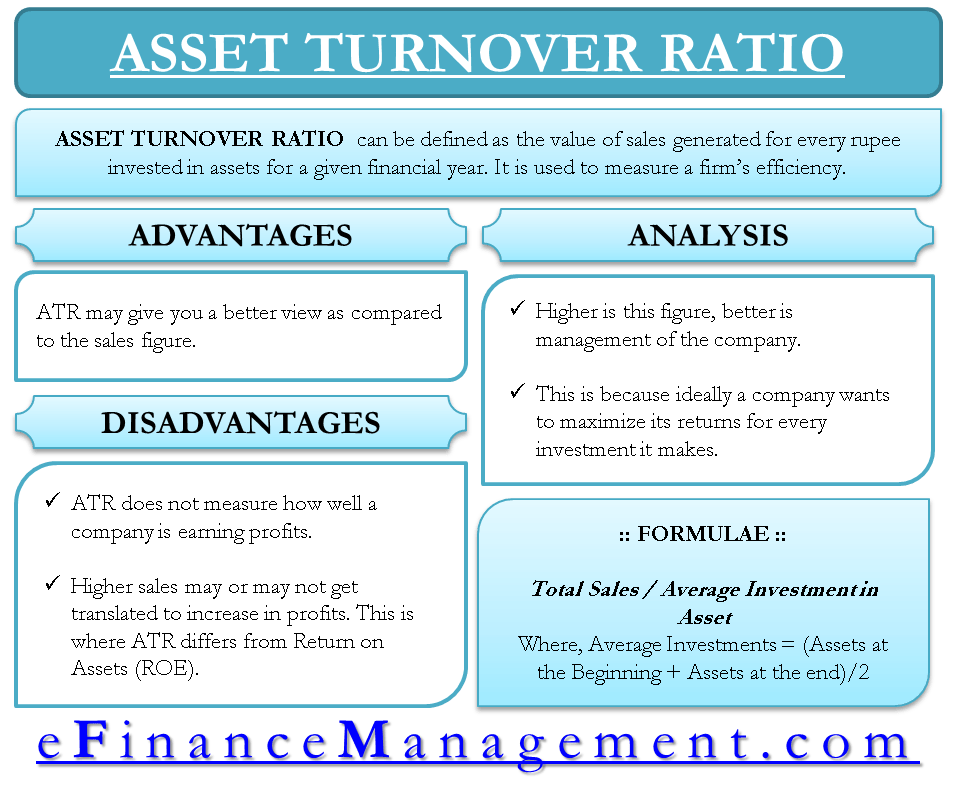

The inventory turnover is 3. Revenue is the total value of goods or services sold by the business. An asset turnover ratio measures the efficiency of a companys use of its assets to generate revenue.

Turnover is the income that a firm generates through trading goods and services. Assessment day for an income year of a life insurance company has the meaning given by section 219- 45. His accounts receivable turnover ratio is 10 which means that the average accounts receivable are collected in 365 days.

Assets are reported on a. In year 2 this ratio increased indicating. We already know the inventory turnover.

Enter the email address you signed up with and well email you a reset link. A ratio of 04 means youre only generating 040 for every dollar you invest in assets. Current Asset Turnover Year 2 3854 766 503.

Accounts Receivable Turnover Days Year 1 266 3351 360 285. Accounts Receivable Turnover Days Year 2 325 3854 360 303. You should see a corresponding increase in sales.

Remember me on this computer. Two different ratio methods are used in human resource forecasting. Reliance on Revenue Source Revenue Source Total Revenue Measures the composition of an organizations revenue sources examples are sales contributions grants.

A higher ratio implies that management is using its fixed assets more effectively. Its not risky but it is also not very safe. This indicates a slight decline in firms ability of generating sales through its current assets such as cash inventory.

It would seem a little contradictory to say that even a very high receivable turnover ratio is not good. The current ratio is 275 which means the companys currents assets are 275 times more than its current liabilities. Thats why its.

The fixed asset turnover ratio reveals how efficient a company is at generating sales from its existing fixed assets. A ratio of 21 or. Equity Turnover Ratio Example.

Accounts Receivable Turnover in year 1 was 285 days. Particulars Company A in. Staffing ratios and productivity ratios.

It means that the company was able to collect its receivables averagely in 285 days that year. Current Asset Turnover Year 1 3351 656 510. Click here to sign up.

An asset is a resource with economic value that an individual corporation or country owns or controls with the expectation that it will provide future benefit. A ratio of 1 is usually considered the middle ground. For instance an asset turnover ratio of 14 means youre generating 140 of sales for every dollar of assets your business has.

This means that the firm would have to sell all of its current. Not only will it increase the cost of interest to the company but it will also suggest a weak liquidity position of a firm and higher chances of occurring bad debts. This move is very risky as by doing this the organization is taking on the burden of too much debt and eventually they have to pay the debt with interest.

MBA Finance Project Report on Ratio Analysis. Log In Sign Up. Generally a high asset turnover ratio is considered good as it shows that receivables are quickly collected and only a little excess inventory is kept Thus a fund manager who follows a buy-and-hold manager will have a low ratio whereas a manager with a more active strategy will experience a highGenerally a higher.

Current ratio is a useful test of the short-term-debt paying ability of any business. That bodes well for his cash flow and his personal goals. To find the inventory turnover ratio we divide 47000 by 16000.

Close Log In. If any company wants to increase the equity turnover ratio to attract more shareholders it may skew the equity by increasing the debt percentage in the capital structure. Current ratio Current assetsCurrent liabilities 1100000400000 275 times.

Staffing ratios are used to predict hiring need based on established organizational. Asset of a sub-fund of a CCIV means any of the assets of the sub-fund ascertained in accordance with Subdivision B of Division 3 of Part 8B5 of the Corporations Act 2001. Is it recurring is your market share.

Very High Receivable Debtors Turnover Ratio. But this may also make him struggle if his credit policies are too tight during an. Since the working capital ratio measures current assets as a percentage of current liabilities it would only make sense that a higher ratio is more favorable.

Ps4 apk download for android 2020. In the second example well use the same company and the same scenario as above but this time compute the average inventory period meaning how long it will take to sell the inventory currently on hand. Turnover ratios that are used widely are inventory turnover ratio asset turnover ratio sales turnover accounts receivable and accounts payable ratio.

Turnover Ratios Definition All Turnover Ratios Uses Importance Efm

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

0 Comments